During his recent visit to Pakistan, Emir of Qatar Sheikh Tamim bin Hamad Al Thani offered Prime Minister Imran Khan his country’s cooperation to transform five big airports of Pakistan. As per reports, Qatar will help replace outdated systems and infrastructure with modern technology and will provide financial support for the process to modify them on model of Qatar airport.

A day before Judge Arshad Malik is set to appear before Supreme Court in a case pertaining to investigation of the controversial secretly taped video of him, the judge has requested the law ministry to provide him ‘foolproof security’. Citing life threats to his family and him, Malik pleaded law ministry to not withdraw current security detail assigned to him.

A technical snag, less than an hour before blast off shattered India’s dreams to become the fourth nation to land a spacecraft on the Moon. The launch system of the Chandrayaan-2 — or Moon Chariot 2, experienced some technical problem and a revised date for the launch will now be announced by the Indian Space Research Organisation (ISRO).

Supreme Court’s order of removing service/maintenance charges on pre-paid mobile scratch cards has now been implemented. Users will now receive Rs88.9 on Rs100 mobile scratch card compared with Rs76.94 previously. Mobile phone service providers were told by the court that they could apply a 12.5 per cent withholding tax. However, they had to abolish 10pc administrative/service charges.

Reko Diq mines, known for their enormous reserves of gold and copper are believed to have the world’s fifth largest gold deposit in them. The news of the treasures this mine holds is not new, as gold diggers have been attempting to explore it since 1992. It was not until 2000, that the Tethyan Copper Company made its way into Pakistani market.

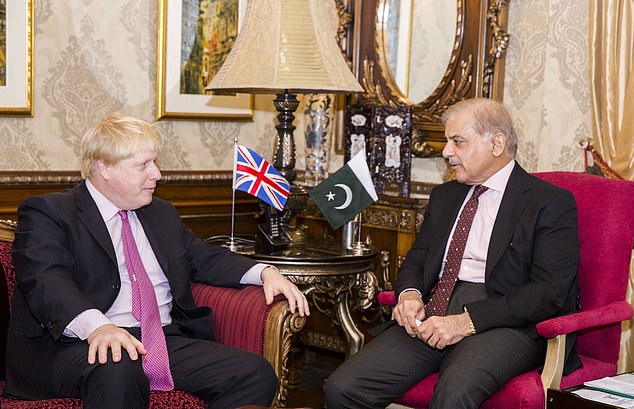

A recent investigation report by Daily Mail alleges that Shehbaz’s son-in-law, Ali Imran, embezzled about £1million from a fund established to rebuild the lives of 2005 earthquake victims. Britain’s Department for International Development gave £54 million in aid money to this fund. The report also gives details of how the Sharif family laundered millions, received via kick-back in different projects, to UK.

The International Center for Settlement of Investment Disputes (ICSID) has announced a massive $5.976 billion (Rs944.21 billion) award against Pakistan in the Reko Diq case, which is one of biggest in ICSID history. ICSID awarded a $4.08 billion penalty and $1.87 billion in interest. However, Pakistan has decided to challenge the award “very soon” by filing a revision application.

A joint statement issued in Washington has revealed that United States, China and Russia have warmly welcomed Pakistan to a four-party consultation process aiming to bring peace to the war-torn region of Afghanistan after 18 years. The statement recognises Pakistan’s role in Afghan peace process and justifies Islamabad’s view that any development in Afghanistan also impacts Pakistan.

Honda Atlas Cars Pakistan (HACP) has decided to shut down its plant for 10 days as its inventories piled up to 2,000 units on plummeting car sales amid rising prices due to imposition of new, higher taxes in budget and steep currency devaluation in recent weeks. Extremely low car sales during first week of July has prompted the company’s decision.

The State Bank of Pakistan (SBP) has launched the “Prime Minister’s Kamyab Jawan SME Lending Programme,” worth Rs100 billion for startups and small and medium-sized enterprises (SMEs). Citizens aged between 18 and 45 years may avail financing of up to Rs5 million each at a borrowing cost varying between 6% and 8% for a maximum period of eight years.