The Federal Board of Revenue (FBR) has extended the deadline for the submission of income tax returns for Tax Year 2019 to December 16, 2019 from November 30, 2019. Same is the case for the companies, which were due to submit returns for the Tax Year 2019 on September 30, 2019, later extended up to November 30, 2019. Companies that have paid 95 percent of the admitted tax liability on or before September 30, 2019, can submit returns by December 16, 2019.

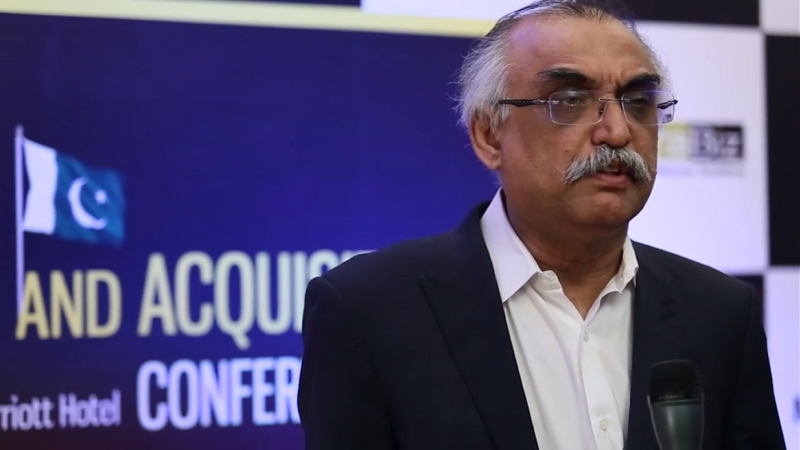

Chairman Federal Board of Revenue (FBR), Syed Shabbar Zaidi announced the tax returns filed per day in 2019 have increased by 127% on average as compared to last year. Tax returns filed in 2019 till October 25 stands at 918,027, as compared to 585,209 tax returns filed in the same period last year according to Zaidi’s tweet. Personal interactions between FBR employees and businessmen will not be allowed soon.

The Federal Board of Revenue (FBR) has decided to include unregistered doctors into tax net, in order to broaden the tax base. FBR has given Pakistan Medical and Dental Council (PMDC) to submit details of its members within 10 days. Most doctors registered with PMDC are not filing their tax returns, despite it being mandatory requirement by the board.