Any product imported into Pakistan through postal or air courier services with a declared value up to Rs. 5,000 will be exempt from customs duty or any other types of taxes. An FBR official explained that this move has been taken as a relief for the end-users, most likely to be private individuals as opposed to corporate importers.

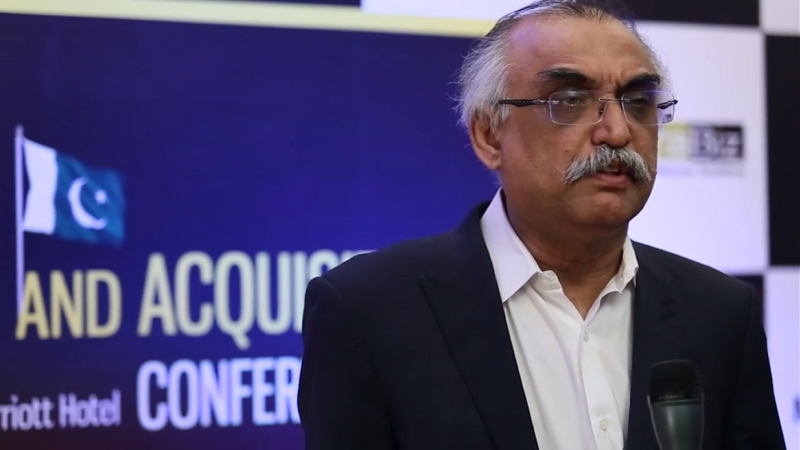

Chairman Federal Board of Revenue (FBR) Shabbar Zaidi has warned of strict action against the import of Indian-origin products in the country using regional ports. He said that the tax authority is noticing import circumvention with respect to goods of Indian origin. As per the World Trade Organization (WTO), rules of origin are the criteria needed to determine the national source of a product.

The Federal Board of Revenue (FBR) has extended the deadline for the submission of income tax returns for Tax Year 2019 to December 16, 2019 from November 30, 2019. Same is the case for the companies, which were due to submit returns for the Tax Year 2019 on September 30, 2019, later extended up to November 30, 2019. Companies that have paid 95 percent of the admitted tax liability on or before September 30, 2019, can submit returns by December 16, 2019.

The Federal Board of Revenue (FBR) has decided to replace the existing General Sales Tax (GST) with Value Added Tax (VAT) across the board for all sectors under World Bank’s funded loan conditions. According to FBR Chairman Shabbar Zaidi, FBR will gradually move towards full implementation of VAT in order to ensure all sectors contribute to the country’s taxation system.

Chairman Federal Board of Revenue (FBR), Syed Shabbar Zaidi announced the tax returns filed per day in 2019 have increased by 127% on average as compared to last year. Tax returns filed in 2019 till October 25 stands at 918,027, as compared to 585,209 tax returns filed in the same period last year according to Zaidi’s tweet. Personal interactions between FBR employees and businessmen will not be allowed soon.

Urdu website is launched to facilitate the taxpayers by Chairman Federal Board of Revenue (FBR) Syed Muhammad Shabbar Zaidi. The Urdu website offers online facilitation and services to the taxpayers about Income Tax, Sales Tax, Custom etc. and also information related to it. The website allows the users to file a complaint as well as seek response to their queries in the national language.

The Federal Board of Revenue has now made it mandatory for all citizens to show Computer National Identity Card (CNIC) in case of purchase over Rs50,000 from a registered sales tax seller. The move will help avoid, unverifiable and fictitious business buyers which results in sales tax losses. In case of female buyers, CNIC of husband or father must be shown.

The Federal Board of Revenue (FBR) has decided to transfer more than 2,500 of its officials between grade 14 and grade 22, in an attempt to break their nexus with businesses and improve efficiency. In order to achieve its target of collecting a massive Rs5.550 trillion in fiscal year 2019-20, people with tainted reputation are also being sidelined.

Pakistan Telecommunication Authority (PTA) and the FBR in a collaboration to curb smuggling of mobile phones have decided to reduce taxes on imported mobile phones to almost half. However, if international travelers fail to register their phones within a time frame of 60 days, they will have to pay an extra 10 percent fine with the tax.

Around 90,000 people have gained advantage from the Asset Declaration Scheme, sources from FBR have claimed. Total volume of tax revenue after the extended deadline for amnesty scheme could reach Rs. 70 billion, as another 1,00,000 people are expected to declare their assets. For the first time number of tax filers have passed the two million mark in the country.