The International Monetary Fund (IMF) has asked Pakistan to freeze all major non-development expenditures heads, including salaries and defence, in order to bring down primary deficit. The IMF staff proposed Pakistan to to undertake massive fiscal adjustments of Rs1,150 billion to bring down primary deficit at negative 0.4 percent of GDP for the upcoming budget 2020-21 post COVID-19 pandemic.

Owing to the outbreak of the Corona pandemic, around three million Pakistanis are expected to go jobless. The findings were submitted by the finance ministry to Senate on Friday. Out of the three million jobs, the industrial sector is likely to lose one million and the remaining two million will be lost in the services sector.

The Oil and Gas Regulatory Authority (OGRA) has directed petrol pumps to maintain a minimum supply of 20 days. In order to ensure the quantities OGRA has asked Hydrocarbon Development Institute of Pakistan (HDIP) to physically inspect the availability of petrol and high speed diesel at depots, retail outlets (petrol pumps) and refineries of all oil companies.

Pakistan is looking to remove the ban on the export of COVID-19 personal protective equipment (PPE) this week. This will allow local manufacturers to export COVID-19 related material overseas. Federal Minister for Science and Technology Fawad Chaudhry took to Twitter to announce this. It was also announced that Pakistan has received a large number of orders for face masks from different parts of the world including the US, Canada, and Europe.

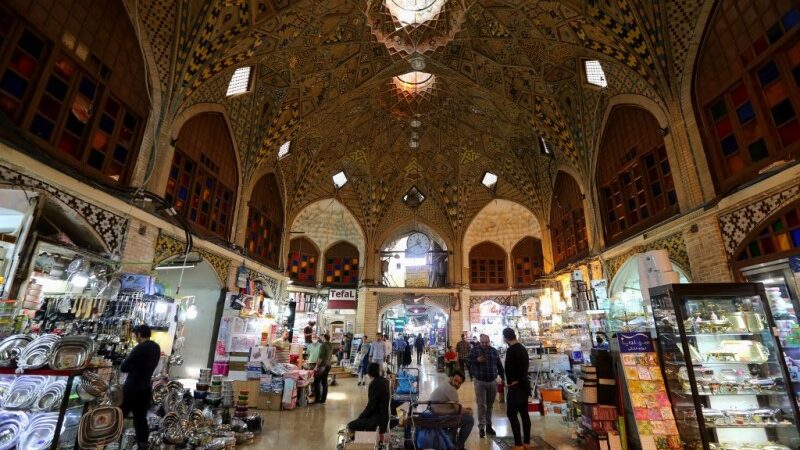

An eerie silence had fallen over Istanbul’s Grand Bazaar, one of the world’s oldest and largest markets it prepares to reopen. There are now signs of life at the market as workers roam its alleys, spraying the floor, columns and walls ahead of the doors reopening on Monday for the first time in two months.

The ride-hailing service Careem announced on Monday that it will lay off 536 of its employees, representing 31% of its workforce, this week. Careem CEO Mudassir Sheikh said in a blog on the company’s website that their business is down by more than 80% and the recovery timeline is alramingly unknown. The company, which primarily operates in the Middle East, is owned by Uber.

Berkshire Hathaway Chairman and billionaire value investor Warren Buffett said that the conglomerate has sold the entirety of its position in the U.S. airline industry. The prior stake, worth north of $4 billion dollars, included positions in United, American, Southwest and Delta Airlines. He said that the world has changed for the airlines and he does not know how it’s changed.

Local one tola and 10 gram gold price in the country reached a peak of Rs100,400 and Rs86,076, respectively, on Tuesday. There was a gain of Rs700 and Rs600 in per tola and 10 gram prices from Monday. The local bullion body continues to issue “prices only for idea” since the shutdown of local markets – including jewellery shops – due to the Covid-19 lockdown.

Pakistan has urged China to ease in payment obligations of over $30 billion worth of about 12,000-megawatt power projects under the China-Pakistan Economic Corridor (CPEC). This will help Pakistan minimise its financial and economic difficulties. This is part of the ongoing government efforts to secure discounts and savings on power purchases from independent power producers (IPPs) as circular debt liabilities cross Rs2 trillion.

Oil prices fell sharply today, with crude oil near an 18 year low and Brent hitting its lowest since November 2002, as the global coronavirus pandemic worsens. Saudi Arabia-Russia price war shows no signs of abating which could also be one of the possible reasons behind. U.S. West Texas Intermediate (WTI) crude futures fell as far as $19.92, near an 18-year low hit earlier this month, and was last trading down 3.77%, or $20.70 a barrel.